Here at Instant Loan, we take the hassle out of renovation loan applications. We do this by allowing you to quickly and easily compare today’s top renovation loan quotes from Singapore’s best financial institutions.

-

Breathe new life into your property with a tailored renovation loan

-

Borrow loan amount up to 6 times of your monthly salary

-

Compare low interest rate renovation loans with affordable fees

How Do You Qualify for a Renovation Loan?

In order to qualify for a renovation loan in Singapore, you must usually be:

-

The rightful owner of the property

-

A Singaporean citizen or permanent resident

-

Between 21 and 65

-

Minimum income of $24,000

And also prepare the following documents:

-

Identification Card/NRIC

-

Proof of residence(current utilities bill, a letter of addressed to you or tenancy agreement)

-

Proof of employment(recent 3 months payslip)

-

Singpass(to login IRAS, CPF,HDB website)

-

Copy of the "Option to Purchase"(OTP) of the home you are renovating

-

Invoice from your renovation vendor

In some instances, the co-owner of the property can be the guarantor of the approved loan. Always check your preferred rate and fees, terms and conditions – to ensure you can afford the monthly repayments. Tenors are usually flexible, regardless of whether you require a short or long-term loan.

How Can We Help You?

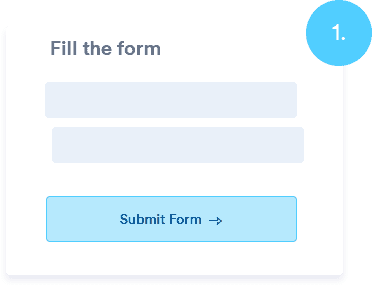

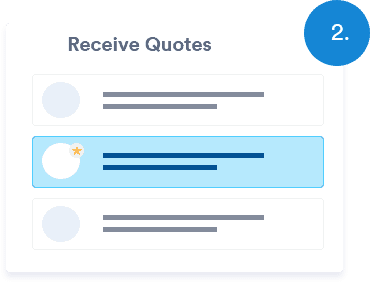

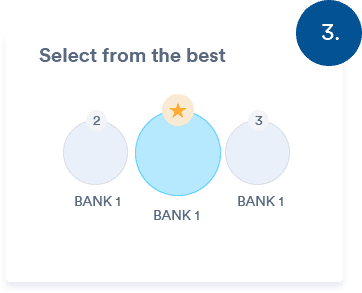

Instantloan.sg is a finance directory site specially designed to match loan customers like you with the top loan providers and best renovation loans in Singapore. With Instant Loan, you can find your perfect low interest rates for renovations in three easy steps:

1. Submit a simple online form

2. Receive up to 3 best renovation loans -- absolutely free!

3. Select and secure the best renovation loan offer that suits you

What is a Renovation Loan?

Singapore renovation loans are specially designed renovation loans for homeowners who want to make property improvements. Using the right renovation loan with a good monthly repayment rate and low fees, Singaporeans can turn standard properties into dream homes by borrowing a set amount to put towards essential or non-essential home improvements.

In a world where typical renovations can cost anywhere up to $100,000, renovation loans can help homeowners access the funds they need to make their dream home a reality.

Whether you’re in need of a whole new roof, a mid-range bathroom revamp, or just looking to cheer up your kitchen, Instant Loan can help you secure a renovation loan with great monthly repayment rates, a generous payback loan tenure, and unrivaled flexibility, regardless of whether you’re looking for a long or short-term loan.

Try out our loan comparison service today.

What Can It be Used to Pay For?

If you’re taking out a renovation loan in Singapore, you can only use that loan for a select few purposes. These purposes range from basic bathroom fittings to the complete rewiring of an entire property. Here’s a few brief examples of what you could put your next renovation loan towards:

-

Electrical and wiring works

-

Structural changes or alterations

-

Tiling, flooring and bathroom fittings

-

Painting and redecorating

-

Fitted cabinets and furniture

-

External works within your home’s compound

Get the Best Renovation Loan Deal in Town

Receive upto 3 loan quotes from the best reviewed and reliable loan providers!

Factors to Consider When Choosing a Renovation Loan

It is important to consider several things carefully when comparing the best renovation loan Singapore has to offer right now with other competitive quotes.

Here at Instant Loan, we recommend reviewing the following 4 points:

Interest rates

The overall cost of borrowing should always be one of your primary concerns when applying for a loan. Naturally, a higher interest rate and fees could result in a higher monthly repayment rate and higher cost overall, so it’s important to select a low interest deal.

Loan amount

You should also think carefully about the amount of money you need and how this compares to the amount of money you can realistically afford to borrow.

Different financial institutions will be offered different maximum and minimum approved loan amount – so this needs to be taken into consideration too. In most cases, the maximum loan you can borrow is 6 times of your monthly salary (subject to legal requirement).

Fees and costs

Renovation loans in Singapore will rarely be fee-free. It’s not uncommon for financial institutions to charge a processing fee when you apply for a renovation loan. You can expect processing fees to be less than 10% of the principal of the loan when a renovation loan is granted.

If you have failed to make the payment on time, it might incur late interest of 4% per month and a fee not exceeding $60 for each month of late repayment.

Loan provider

With dozens of home loan and renovation loan providers on the market, borrowers can always save money by shopping around. For example, the renovation loan DBS has on offer right now has a great interest rate for 2 years, but financial institutions might be offering better overall deals. Also, it’s not uncommon for financial institutions to slash their rates and offer one-off discounts, so it always pays to shop around.

Looking for the perfect renovation loan to meet your home improvement needs? Look no further than Instantloan.sg.

Our quick, easy loan comparison service enables you to retrieve instant quotes from Singapore’s top financial institutions just by filling in a straightforward online form. It’s as simple as that! It’s as simple as that! Try out Instantloan.sg today!

Frequently Asked Questions (FAQs)

Still confused about renovation loans? Unsure about loan tenure? Home loans versus renovation loans? Here’s some common FAQs.

Homeowners can typically only apply for a renovation loan of up to 6 times of their monthly salary with financial institutions.

Homeowners should also keep in mind that many banks impose a minimum loan amount of $10,000 on renovation loans, too.

There are several ways you can apply for a renovation loan, including contacting the best financial institutions in Singapore independently to assess eligibility and discuss your options, or using Instantloan.sg to receive multiple quotes all at once.

Try out our renovation loan comparison service today and compare up to 3 tailored quotes from financial institutions in Singapore absolutely free.

With Instantloan.sg, you can search for and compare quotes from all of Singapore’s best financial institutions in a matter of seconds.

However, once you’ve decided on the right low interest rate renovation loan for you, an in-person appointment with the institution may be required. In most cases, your institutions will need to see evidence of:

- Your NRIC or passport

- Recent 3 months’ payslips

- An invoice from the contractor who intends to carry out the renovations

Renovation loans are specially designed for property owners who wish to make home improvements, and funds must be used to fuel this purpose. In contrast, personal loans can be used for a much broader variety of things, such as buying a new car, holiday or helping you through financial difficulties. It is important to determine which type of loan is best suited to your needs before you begin approaching a financial institution for quotes.

The best way to figure out which type of loan suits you is to enter your details with Instantloan.sg and try out our loan comparison service, which will find tailored loan quotes to suit your unique requirements.

Renovation loans are categorized as special purpose loans, tailored to suit borrowers who intend to use such funds to make home improvements. Interest rates and fees tend to be largely the same. However, borrowers can only take out a renovation loan if they fully intend to use it for home renovation purposes.

Your renovation loan must be used to pay for either:

- Electrical or re-wiring works

- Structural alterations to a property

- Decorating and painting

- Fitted cabinets or closets

- Bathroom fittings and fixtures

- Tiling and flooring

Yes, Singaporeans are allowed to apply for a low interest rate renovation loan either individually or as a joint applicant with their spouse or partner.

Generally speaking, joint applicants must either both be registered owners of the property, or directly related to one another (i.e. spouse, parent, child or sibling) if only one of them is the homeowner. In most instances, your bank will ask for proof of your relationship and additional fees may apply.

With so many amazing financial institutions out there offering low interest rate renovation loans, shopping around for the best deal with the right loan amount to suit you can be challenging.

Fortunately, Instant Loan offers a quick and easy loan matchmaking service to put you in touch with your perfect renovation loan. Just fill in a simple form to compare quotes with low monthly repayments and pick the best interest rate, fees, and tenor to suit you.

Renovation loan interest rates, just like any other loan, vary. When finding the best renovation loan in Singapore, consider these factors: interest rate and term length. The higher the rates are on offer from other financial institutions with shorter terms may seem tempting at first but this will cost you more over time because of all those extra payments.

Personal loans and HELOCs are both common ways to borrow money for a project that will make your house shine.

A HELOC can offer a low initial rate and longer repayment terms than you’ll find with your typical personal loan, but the trade-off is that equity in your home will be at risk if it doesn't cover what you need. If this isn't something you want to do or don't own property, consider taking out a more traditional personal loan for predictable monthly payments.

The answer to that question is not as simple. It depends on your financial situation and the type of renovation you plan for, among other things.

The truth can be difficult depending on what you're looking for from each option--but in general.

With so many banks and loan providers out there, it can be a daunting task. Luckily Instant Loan is here for you! We have created an easy-to-use website that allows you to compare rates on renovation loans from multiple sources by inputting your details such as how much money you need.

You also get access to reviews about each provider which are written based on real customer experience rather than just marketing material put forth by the bank or company themselves - giving you peace of mind that what your reading isn't biased information.

The common problem people face when they are looking for a loan is that it becomes difficult to know which terms and conditions work best with their needs. People usually have no idea what might be the best option, so often times will settle on whatever looks or sounds better than everything else.

However, there really isn't any reason why you should not take just a few minutes before signing anything in order to compare rates online first. This way you can find out exactly how much your monthly payments would be as well as other costs associated with borrowing money like interest charges.

You'll also get an understanding of each company's repayment plan options available by going through Instant Loan: Singapore’s easy-to-use comparison tool! Whether you're looking for personal, business, or other financings, we'll match you with the best option possible in Singapore and at a price that suits your needs.